FAQ

SCHOOL FUNDING QUESTIONS

WHY ARE SCHOOL LEVIES NECESSARY?

HOW OFTEN DO SCHOOL DISTRICTS ASK VOTERS TO APPROVE LEVIES?

WHAT DO YOU MEAN THESE ARE REPLACEMENT LEVIES?

School levies make up the difference between the actual cost of educating students in safe, secure, well-maintained schools and what Washington state pays for that cost. In Snohomish, the two local levy funds pay about 16 cents of every dollar needed for our communities’ children to have full and rich learning experiences in neighborhood schools.

The EP&O REPLACEMENT levy enriches and/or underpins special education, vocational programs and help for excelling and struggling students. The EP&O pays for ACT tests. It pays for more than 56 highly-qualified educators and school staff and helps the district attract and retain people dedicated to student learning – the “people power” necessary to prepare students to be learned, responsible, contributing citizens of the future.

The state pays for fewer than TWO nurses for 15 schools in the district. The EP&O pays for 11 more. The state pays for fewer than TWO school security staff; the EP&O pays for SROs and other security measures.

The state pays for NO activities happening after school or in the summer. The EP&O helps students connect to each other, their schools and the community through athletics, performing arts, clubs and other after-school activities for stronger mental health and academic success.

Prop 2 maintains schools and support facilities. This includes replacing roofs and siding, upgrading heating and ventilation systems. The 2020 bond failure stalled many roofing, HVAC and other repairs, upgrades and replacements. The longer those critical maintenance projects and upgrades are delayed, the more costly they become. Schools must be maintained timely and routinely, just as homes and businesses must be. The state does not cover all of these local maintenance costs.

Prop 2 improves school safety. In our changed world, keeping students, staff and visitors safe is increasingly important. Prop 2 includes buying and upgrading security cameras. It improves school parking lots and “drop off” and “pick up” access, elementary school playgrounds, and portable classrooms.

Prop 2 continues access to educational technology. We all learned during the pandemic the importance of technology and equitable access to equipment and the internet. Prop 2 continues providing local levy dollars for educational technology and access for students – what they need to be successful in school and to gain skills for their successful futures.

Both levies on the ballot for Feb. 8, 2022 are four-year REPLACEMENT levies. School districts can ask for levies to last two to six years. It helps districts to make long term plans for student learning if long-term funding is available. Both 2022 levy requests are for funding over four years.

WHAT IS THE DIFFERENCE BETWEEN A SCHOOL CONSTRUCTION BOND AND A SCHOOL LEVY?

Here’s a video that helps explain the difference.

Voters approved levies of these types four years ago. Both of those past voter-approved funding sources expire at the end of 2022. To ensure quality educational programs for students in safe and well maintained schools, the district is asking registered voters in the school district to once again approve the expiring levies – to “replace” them.

What's more, in the case of these levies, the funding will be continued at a reduced tax rate for property owners. The combined local school tax rate for these two replacement levies AND the costs of paying off old bonds will be lower than property owners have seen since 2018.

QUESTIONS ABOUT VOTING

WHO CAN VOTE IN THE FEB 8, 2022 ELECTION?

HOW DO I REGISTER TO VOTE? HOW CAN I CAST MY BALLOT?

Registered voters who live within the boundaries of Snohomish School District.

The county will mail a ballot to every registered voter in the school district in January 2022. For full details about ballot timing and voter registration visit the Snohomish County website.

LEGAL QUESTIONS

WHY DO SCHOOL DISTRICTS RUN ELECTIONS IN FEBRUARY INSTEAD OF NOVEMBER?

IS THE DISTRICT PAYING FOR AN ELECTION CAMPAIGN ABOUT SCHOOL TAXES?

Voter-approved funding expires in December at the end of each levy term. School districts build their budgets each spring, in synch with and in preparation for the next school year starting in September. Therefore, to build budgets for the next full September-June school year, the district must know what funding is available in the spring, not wait until November to find that out.

No. It is the district’s responsibility to make factual information available to the community – about district services, operational needs and any proposed ballot issues. However, the district may not, by law, use any publicly-funded, school district funds or facilities to advocate how you vote on any candidate or ballot measure.

The campaign committee advocating that you vote YES on the two Feb. 8, 2022 school district levies is run by volunteer community members and funded by donations. The committee name is Yes! Snohomish. District information is clearly labeled as coming from the district. Campaign materials are clearly labeled as coming from the campaign. This website is the Yes! Snohomish campaign website.

TAX QUESTIONS

ARE THESE NEW TAXES THAT WILL INCREASE THE TAX RATE I ALREADY PAY FOR SCHOOLS?

No, these are replacement levies. The levies you are now paying for will expire at the end of 2022. To continue the quality education our community expects and that students need to be future-ready, the district is asking for continued approval of reliable funding in the form of these two replacement levies.

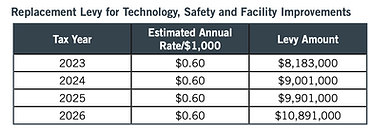

What’s more – the local school levy tax rate you will pay when these levies are approved and which the county will begin collecting in 2023 will be LESS than what you are paying now. This is because the district has been paying off past voter-approved bonds. As those bond payments are becoming lower, the local school tax rate you will pay beginning in 2023 will be LESS than what you have paid in local school taxes since 2018. See charts.

SOME DISTRICTS HAVE HIGHER OR LOWER TAXES RATES. WHY IS THAT?

Local, voter-approved funding for schools is based upon property value in that school district. Some districts, such as Everett and Monroe, have lots more business property than Snohomish does. In those business-rich districts, school financial support costs are shared by both business property value and residential property value, and the tax rate needed to collect that support is less. In Snohomish, with fewer business property to share the cost of local school support, most local school financial support comes from residences, making the residential share higher than it would be if more businesses were in the district.

HOW CAN I GET AN EXEMPTION TO PAY LOWER PROPERTY TAXES?

Snohomish County handles that. You can connect with them and find more info on the Snohomish County website.

HOW DOES SNOHOMISH SD TAX RATE COMPARE TO OTHER DISTRICTS?

Snohomish SD's combined tax rate for Prop. 1 & 2 ranks "in the middle of the pack" when compared to other districts collecting for similar levies. You can see that comparison chart on the district website.

WHEN MY PROPERTY VALUE GOES UP, DOESN'T THE DISTRICT GET MORE MONEY?

No. By law, the district must tell voters precisely how much money it will collect each year of a levy’s life. The district cannot collect more than that amount, no matter how property value fluctuates.